Becoming debt-free and living without debt is a dream many of us have, especially when we find it hard to advance in life financially. We see living with debt as a burden and it can put a damper on us in so many ways.

From mental issues and emotional problems, living with debt needs to be dealt with in a positive tone. It is the only way you will overcome the idea of having debt and stop allowing it to control you.

There are no set amount of steps for becoming free of debt. Arguably, you could be debt-free in one step: make enough money to pay off your debt or win the lottery. As that may be the overall idea, it will take time and plenty of patience to achieve.

When living paycheck-to-paycheck it is important to remember it is where your money goes and not the amount you make. Many people choose to use their money for useless things that will give them nothing in return, aside from brief satisfaction.

They are thinking of the now as opposed to the future.

Believing in the ideology of living every day as if it were your last makes sense because it could very well be, however, the chances are quite slim. Stop thinking that way and begin imagining a future where you no longer need to worry about money.

What would you be doing with your life if money was not in the equation?

Essentially, the idea of getting out of debt is easy once your mindset changes. You are the only person in the world to change the way you think and once that happens, you will become unstoppable. Saving money will become an absolute obsession and that is a good thing.

Assess Your Finances

Going off the concept of not having any assets you need to first assess your income and expenses. Your income is important because it determines how much you are allowed to spend each month, however, having low expenses is where you really need to focus.

The majority of people spend every penny of their paycheck and are never prepared for financial emergencies. Lowering your expenses will allow additional income earned to be saved for an emergency or future endeavors.

Expenses that are usually consistent on a monthly basis include rent, car payments, insurance, and utilities. These common monthly expenses generally cannot be avoided but the others can. Other expenses may include eating out, cigarettes/alcohol, streaming services, gambling, etc.

It may be hard to take away some of the luxuries and habits we currently have, but for the sake of saving money, consider asking yourself if it is worth it to have. You could easily go back to spending all your money and having the attitude “Well, I could die any day so what is the point of saving?”

Instead, take the positive approach and look forward to being in a healthier position financially this time next year. Saving money is much harder than spending, but so much more rewarding.

Keep reminding yourself it is not about how much you make, but how much you save and expend.

Try cutting unnecessary expenses in half for six months and put that money in a separate account. You will start to see the savings add up quickly. This will allow you to begin seeing how well your financial future could become.

Familiarize Yourself with Assets

Be smart with where your money goes because this is where most people mess up. Making more money will not solve your financial issues. There are plenty of people who make over 100k annually and have nothing saved.

Meanwhile, there are financially educated people who make far less while having decent savings and investments.

Your money needs to go towards something that could potentially generate income. This is where assets come into play and where you need to put your money.

Real estate and property are common examples of assets that could generate income. Having as few expenses as possible will allow your hard-earned income to be put towards such assets.

On a side note, the term expense is sometimes interchangeable with liabilities however, they are distinct concepts.

Expenses represent the regular payments your company makes to support its operations on a monthly basis, whereas liabilities are the obligations and debts owed to external parties. For example, your car payment is the expense whereas the auto loan is the liability.

Most people consider their house to be their biggest asset. This may be true in most cases, but in order for assets to be worth something, they need to be generating income.

Owning two homes where you live in one and rent out the other to cover both mortgages is a great example of an income-generating asset. The income generated from an asset helps increase your cash flow.

Cash flow is the money going into or out of a business, or asset. For example, if you rent a home out for $1500 a month and your expenses are $1100, then your cash flow would be $400.

You can then use this cash as added income or do the smart thing and reinvest it into more assets, generating even more money.

Formulate a Budget Plan

This is the hardest step when becoming debt-free because it all comes down to your self-discipline. If you are unable to resist impulse buys and choose to spend money on useless things then you need to change your mindset.

Consider changing your relationship with money if you feel it controls you.

You may not think it now, but if you keep living in a world of debt without caring enough to see where your money goes, you most likely will retire late in life with little to show for it.

It is important to save and get rid of debt early in life so that during retirement you can buy whatever you want.

Sticking to a budget plan is the greatest way to stay in control of your finances. Besides the obvious monthly expenses you cannot escape, start eliminating services or products you could do without.

Furthermore, you have to practice self-discipline in order to make this work.

Formulating a budget plan is super easy to do and takes little time. If you are new to doing finances or now caring where your money goes, then have nothing to fear.

A budget plan comes down to where money is coming in and where it is going. Once you see everything on paper start cutting all expenses you absolutely do not need. No need to eat out every weekend so instead try doing it every other weekend.

The goal is only paying for what you cannot avoid paying such as rent and utilities. Even cutting half of these non-essential expenses in half is an amazing start. Ease into saving money if you feel the need as long as you are saving something.

Income vs Expenses

A high income is generally viewed as successful by most people. What most people forget is that the more you make, the more you spend. This is a problem because making more money will not solve your financial problems.

Stop focusing on your income and more on your expenses. Be active in knowing where your money goes, especially if you are not the one paying the monthly bills. You would honestly be shocked at how much money you could save if you just analyzed your finances.

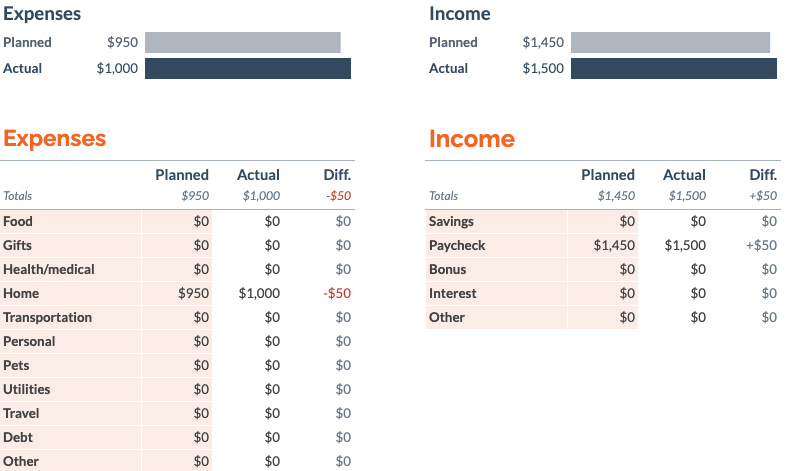

Create a very basic budget plan by using Google Sheets, Microsoft Excel, or whichever method you prefer. Looking at the example below, fill in the blanks with your income and expenses. Once you see your budget plan visually you will be able to adjust.

A great rule is to have your debt-to-income ratio below 35%. This will not only allow you to save money but be more pleasing in the eyes of lenders. When borrowing a lender will want to know you can easily make payments so having a low debt-to-income ratio is necessary.

Your debt-to-income ratio can be determined by adding up your monthly debt payments and dividing it by your monthly income. If your expenses were around $1000 a month and your income was $2000, your debt-to-income ratio would be 50%.

In order to satisfy having a 35% ratio, lower expenses and increasing income would have to happen.

Just remember, it is not how much you make, but rather how much you save and where it actually goes.

Save, Save, Save

Imagine working out to achieve a certain physique. You know the results will not show for at least a month, but once they do and people start to take notice, your motivation will soar.

The same thing applies when saving money. Save money as if it were a game and become obsessed with it. Resist the urge to spend and love the idea of saving. Again, self-discipline is the main factor here.

Spitting up your paycheck is a great way to force savings. Putting 25% of your paycheck into a separate account will force you to begin lowering expenses. It may seem impossible at first, but after a couple of months, you will quickly adapt to this new way of saving money.

For every expense that you are able to cut, save that money separately and wait for six months to see how much you saved. Feel free to spend that all at once or continue saving for something even bigger. Chances are if you made it that far you will continue indefinitely.

Consider putting money into an account that will generate any annual percentage yield. Most of the time a financial institution will require a minimum amount of money in order to be considered.

A high-yield account is something much more preferred over a traditional savings account because it offers a much higher return.

Use coupons for everything you purchase even if you have to substitute certain brands to save. It is not the end of the world having to purchase products that are not name brand. You may even end up liking brands you never tried before.

Save any spare change you have in your car, pockets, couch, etc. Look for any items you no longer use, sell them, and put the money directly into your savings.

Be Patient – It Takes Time!

Now that you know the basics about assessing finances and building a budget plan, it is time to apply these concepts to your daily routine. With these ideas in mind, it is time to focus on the biggest issue most people face, patience.

Being patient takes time and plenty of willpower. Practice patience in your daily routine and it will without a doubt make you a much better person. Saving money for six months is worth every effort regardless of how much it is.

Forcing yourself to save in the beginning will lead to becoming part of your lifestyle. You will start seeing even more ways to save once you are confident enough. You honestly have nothing to lose and would only gain a better understanding of saving money.

Avoid the negative idea of change and embrace it for the positive. This change will impact your future for only the best reasons and is something you should be excited about.

Be proud that you are able to resist useless spending. You are in full control of where your money goes so pay attention. Make sure you are investing in your future and not just your weekend.

**Disclaimer** I am an educated enthusiast of financial literacy and money management. The information provided in this article is for educational purposes only and should not be considered financial advice. I am not a licensed financial advisor, planner, or counselor.

*Featured Image Courtesy of Free Stock photos by Vecteezy